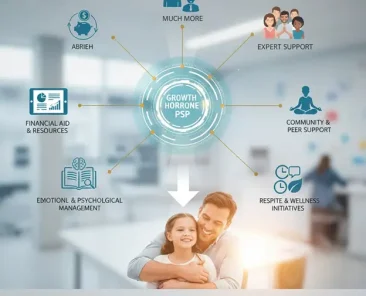

Rare diseases present unique challenges for physicians and patients alike, including small patient populations, expensive and complex treatments, and difficulties in diagnosis and care. In order to improve the success rate of rare disease treatment, pharmaceutical companies often provide integrated support services through the “Patient Support Programs” (PSPs) system service, which provides integrated support services in parallel with therapies to provide assistance to patients and collaborate with physicians to reach treatment plans.

PSPs offer a wide range of services, including insurance navigation, financial assistance, patient education, nursing support, and even medication adherence guidance. With the popularization of rare disease therapy and the maturity of AI pharmaceutical technology, more than half of the new drugs approved by the US FDA are used for rare diseases), and the importance of PSPs is also becoming increasingly prominent.

The investment value of PSPs in rare disease management can be seen in key performance indicators such as adherence, patient satisfaction, drug accessibility, treatment outcomes, and cost-effectiveness, and in recent years, leading pharmaceutical companies in the field of rare diseases, such as Takeda, Sanofi, Novartis, and Pfizer, have become increasingly precise in their investments in PSPs.

The impact of PSP on key indicators and investment benefits

From a pharmaceutical company’s perspective, investing in rare disease PSPs can provide several substantial business benefits:

- Increased Patient Retention and Loyalty: By helping patients stay with their treatment and feel supported, PSPs foster patient loyalty to the product and the company. Patients who receive emotional, financial, and medical support are more likely to continue treatment and trust the brand, building long-term loyalty. abbvie offers an extensive support program (“Humira Complete”) for patients with Humira (although not a rare disease drug, but treats complex immune diseases). The program’s studies showed concrete benefits: patients who participated in the program improved adherence by about 29% at 12 months and maintained better adherence over 2-3 years, with a 30% lower risk of discontinuation and a significant reduction in hospitalizations than those who did not participate. ABBBVIE uses these results to demonstrate that its patient services improve real-world outcomes and patient retention. This case is often cited as evidence that PSPs can drive both health and business outcomes (longer duration of treatment per patient).

- Expanding Market Penetration and Accessibility: PSPs effectively increase market penetration by removing barriers to treatment initiation. They provide insurance navigation, financial assistance, and education, leading to higher rates of new patients starting treatment. Metrics such as “shorter time to first dose” and more patients adhering to treatment can prove the value of PSP to prescribers. Physicians are also more inclined to prescribe medications that provide patient support, knowing that patients will receive more complete care outside of the office. Sanofi’s programs for certain rare diseases include free counselor services for patients and families, which is especially important for pediatric rare disease caregivers who need guidance. This psychosocial support increases patient satisfaction and indirectly improves adherence (families who feel supported are more likely to adhere to a cumbersome treatment regimen). It also distinguishes its offerings by emphasizing Sanofi’s commitment to the overall well-being of its patients, not just the supply of medications.

- Data Generation and Real-World Evidence (RWE): PSPs generate a wealth of real-world data on how patients use medications, adherence patterns, outcomes achieved, and reasons for discontinuation. This real-world data (RWD) is extremely valuable to pharmaceutical companies. Companies can analyze PSP data to gain insights into patient needs and treatment outcomes in non-clinical trial settings. This helps provide better evidence for regulators and payers: for example, long-term outcome data collected by PSPs can support regulatory approval for new indications or meet post-market study requirements. Several companies have now integrated RWE collection into their PSPs – for example, PSPs providers offer patient support paired with electronic health record data to continuously collect results with patient consent. For pharmaceutical manufacturers, this wealth of real-world evidence can inform ongoing development (drug lifecycle management) and reinforce the argument for the effectiveness of their therapies in practice.

- Improved Patient Satisfaction and Brand Reputation: A well-functioning PSP can greatly improve the patient experience, which in turn enhances the company’s reputation. High patient satisfaction, often measured by questionnaires or NPS, indicates that pharmaceutical companies provide value beyond the drug itself. Such positive experiences increase the likelihood that patients will continue to receive treatment and promote the therapy in the patient community. In the field of rare diseases, the power of word of mouth and community advocacy is huge; Pharmaceutical companies that invest in patient-centric services can position their brands and products as patient-friendly. This goodwill can translate into stronger relationships with patient advocacy groups and even regulators, which are increasingly encouraging patient-centric drug development.

- More in line with the value-based model: As healthcare shifts to value-based care, pharmaceutical companies need to demonstrate that their therapies do improve outcomes at cost-benefit ratios. PSPs help in this regard by improving real-world outcomes (adherence, avoided complications) associated with drugs. Increased adherence means payers see better value for expensive rare disease therapies. In fact, improving treatment adherence through PSP “enhances the value proposition of the product” and reduces payer uncertainty about outcomes. Some innovative arrangements tie PSPs directly to value-oriented contracts. For example, there is a global model where manufacturers offer financial relief (Outcome based Rebate) if a patient receives expensive treatment and fails to achieve the desired outcome. These contracts are only feasible if there is strong patient support and monitoring to track results. By investing in PSPs, pharmaceutical companies deliver services aligned with value-driven care goals In one case, Novartis received permission from the U.S. Office of the Inspector General (OIG) to provide travel and lodging support to low-income patients undergoing its CAR-T gene therapy (Kymriah), improving accessibility and complying with regulations. Such support not only helps patients, but also demonstrates to policymakers and payers the company’s commitment to outcomes (ensuring that patients can safely and physically receive treatment and follow up over time).

The strategic advantages brought by PSPs

In addition to real-time metrics and return on investment, PSPs provide pharmaceutical companies with a broader strategic advantage in the rare disease space:

- Product Differentiation: In a highly competitive therapeutic landscape, including rare diseases with multiple treatment options, a strong PSP can differentiate a product. A well-designed PSP “proves the value of a product that goes beyond standard efficacy and safety measures.” In fact, payers will see PSP services as an important differentiator when evaluating similar drugs. By truly addressing patient needs (education, financial assistance, care coordination), PSP makes therapy not just a medicine but a comprehensive solution. This can influence physicians’ commitment to patient care, leading them to lean towards the company’s products. For example, Takeda and Sanofi have made their enzyme replacement therapies stand out in the treatment of rare genetic diseases by providing extensive patient support (at-home injections, disease education, etc.), making their products more attractive to providers and patients. Research and industry experts point out that patient-centric PSP is a “win-win” situation that improves outcomes and provides added value to pharmaceutical companies’ products.

- Accelerated market penetration: The go-to-market phase of rare disease drugs can be improved by simplifying the onboarding process for new patients through hub services. PSPs provide faster patient onboarding validation, pre-authorization support, and patient education to enable faster pharmaceutical post-market treatment initiation. This means that new therapies can gain a foothold in the market faster. Also, as mentioned earlier, physicians feel more comfortable prescribing new rare disease drugs if there is a support infrastructure (they know patients will be helped with complex self-injections, side effect management, etc.). In Asia, where awareness of rare diseases may be low and healthcare systems are fragmented, PSPs can also accelerate penetration by bridging the gap. Companies such as Takeda have leveraged PSPs in Asia, such as in Southeast Asia, by partnering with NGOs and patient groups or professional advisors to increase diagnosis rates and access to treatment for eligible patients, thereby expanding the therapeutic market.

- Stronger stakeholder relationships: Patient support programs can improve a pharmaceutical company’s relationship with key stakeholders—regulators, payers, and providers. Regulators see the value of programs that ensure safe use and monitoring (some programs require risk assessment and mitigation strategies, drug risk assessment and management plans (REMS), which often include a patient education component, are actually a form of PSP. And better adherence data reduces payer uncertainty and strengthens the value argument of the drug. When manufacturers can demonstrate through their PSP data that “patients receiving our therapies stick to treatment longer and have better outcomes,” this will enhance bargaining power in pricing and reimbursement negotiations. Providers (medical professionals) also benefit: PSPs handle ancillary aspects (insurance payment paperwork, patient training), reducing the burden on the medical unit and also making medical professionals more willing to be partners.

Regional barriers and efforts to develop PSPs

United States: In the United States, PSPs (often referred to as “hubs” for specialty drugs) are an established part of rare disease product strategies. They are designed to address the complex reimbursement landscape and ensure that patients do not interrupt their treatment due to financial or logistical obstacles. However, its utilization is still not maximized – surveys have found low patient awareness and engagement (only about 3-8% of eligible patients use these programs, mainly due to lack of awareness). Pharmaceutical companies are working to bridge this gap by enhancing PSPs through physicians, pharmacists, and digital channels. Strict compliance and regulatory scrutiny in the U.S.: Companies must carefully design PSPs to avoid being seen as incentives (e.g., certain co-pay assistance is restricted in federal programs). Despite these challenges, the trend is that patient support is becoming an integral part of the marketing of rare disease therapies, and companies such as Pfizer are creating dedicated rare disease support platforms (such as pfizer’s “Together for Rare” and the VyndaLink program for tafamidis patients) to connect patients to the services they need, and a well-functioning PSP can improve treatment continuity. abbvie’s Humira® case illustrates this: By providing care support, education, and follow-up care, the company achieved measurable 1-3-year improvements in adherence and significantly fewer hospitalizations in patients who participated in its PSP than those who did not.

Asia: In Asia, the deployment of PSPs is accelerating, although maturity varies by country. In Japan and South Korea, many global pharmaceutical companies expand their patient support services (education, call centers, etc.) when products are launched, similar to Western markets. PSPs are a newer concept in emerging Asian markets but are gaining traction, often focusing on accessibility and affordability. For instance, India now offers PSPs for oncology, rare genetic diseases, and other specialties. In India, as 70% of the market is self-funded, PSPs primarily provide financial counseling, free drugs or co-payment assistance, and patient education. Disparities remain: many programs are urban-centric and fragmented, with limited coverage in rural areas and language barriers. Awareness is also a problem in the Asian market, unlike the US PSPs that are open and officially available for reference. PSPs in Asian countries are very difficult to find. The more open information is that in China, patient support programs have been encouraged to improve access to rare disease drugs (e.g., through charitable foundations or tiered pricing schemes), and compassionate use and PSP-like frameworks are being discussed in Southeast Asian countries.

In Taiwan, PatientsForce has implemented PSP services for major international pharmaceutical companies, covering insurance navigation, financial assistance, patient education, nursing support, and even medication adherence guidance, and even the connection between home medical care and home care systems.

- Bessette L, Lebovic G, Millson B, Charland K, Donepudi K, Gaetano T, Remple V, Latour MG, Gazel S, Laliberté MC, Thorne C. Impact of the Adalimumab Patient Support Program on Clinical Outcomes in Ankylosing Spondylitis: Results from the COMPANION Study. Rheumatol Ther. 2018 Jun; 5(1):75-85. doi: 10.1007/s40744-018-0109-3. Epub 2018 Apr 9. PMID: 29633196; PMCID: PMC5935622.

- Fendrick AM, Brixner D, Rubin DT, Mease P, Liu H, Davis M, Mittal M. Sustained long-term benefits of patient support program participation in immune-mediated diseases: improved medication-taking behavior and lower risk of a hospital visit. J Manag Care Spec Pharm. 2021 Aug; 27(8):1086-1095. doi: 10.18553/jmcp.2021.20560. Epub 2021 Apr 12. PMID: 33843252; PMCID: PMC10394214.

- Nicholas Basta, Editor Emeritus & Nicholas Basta, Editor Emeritus; (2022, April 8). The pulse of rare disease support. PharmaCommerce. https://www.pharmaceuticalcommerce.com/view/the-pulse-of-rare-disease-support

- Pm. (2024, June 27). THINK TANK: Creating better rare disease patient support programs. PM360. https://www.pm360online.com/creating-better-rare-disease-patient-support-programs/#:~:text=Better%20treatment%20adherence%20can%20reduce,result%20in%20improved%20patient%20outcomes

- Singh, B. (n.d.). Patient Support Programs (PSP’s): A comprehensive guide. Pharma Now. https://www.pharmanow.live/leadership/patient-support-programs-pharma